Housing market experienced changes in supply and demand, interest rates, and inflation during the pandemic. These factors have caused housing costs to increase to historic highs. The market remains at these extreme prices post-pandemic leaving home buyers deciding what is affordable.

The price of houses in Lafayette increased 32% between 2020 and 2022 according to Sean Hettich, real estate broker and market analyst. The typical annual increase is 2.2%. The housing market accumulated 15 years of appreciation in only two years. The cost of housing started a steady climb during COVID-19 and continued to rise. The pandemic marked the beginning of problems with inflation, supply and demand, and interest rates.

Hettich noticed the significant change in home appreciation at the beginning of 2020. According to Multiple Listing Services, the current median housing cost has risen to $245,184 for the Acadiana area including Lafayette, Iberia, St. Landry, St. Martin, and Vermilion parishes.

The price of houses increased dramatically due to several factors related to COVID-19. The United States government attempted to ease the recession by implementing stimulus and relief packages such as interest rate cuts and loans and asset purchases. The changes in the housing market are a direct result of these fiscal stimulus packages.

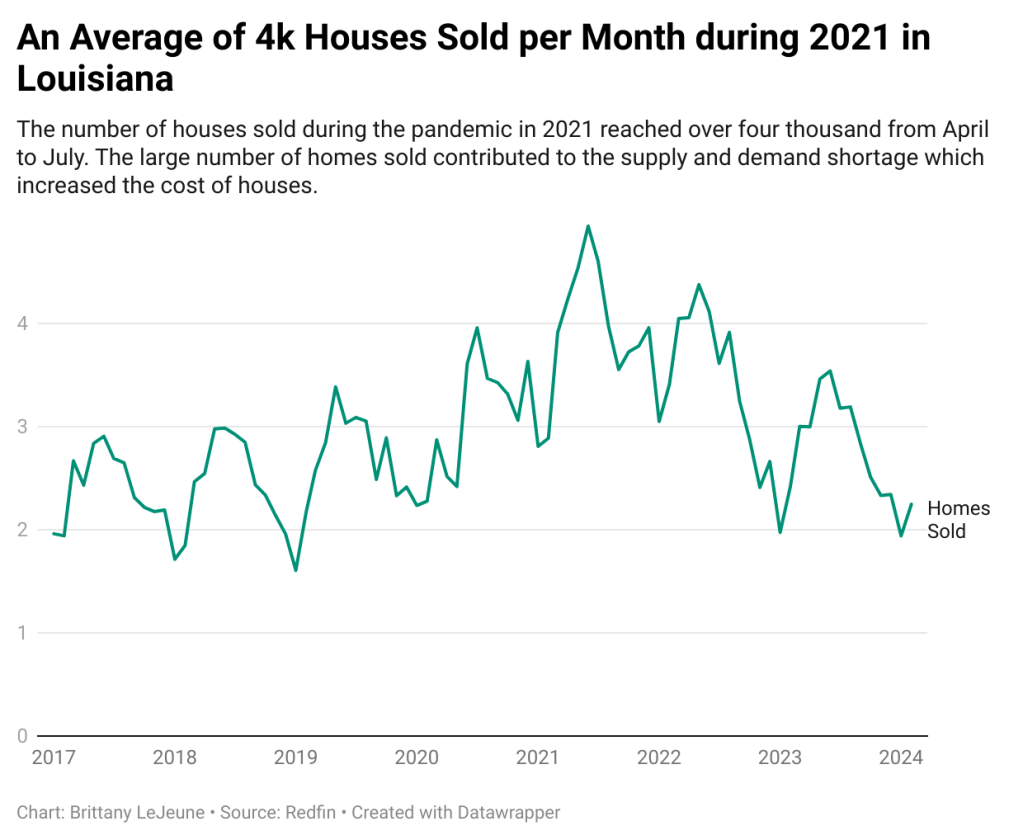

With interest rates at unprecedented lows, buyers began to bid on houses faster than homeowners listed them. The thousands of houses that were sold during the months of the pandemic left no homes on the market. This created a high demand when the supply of properties for sale was very low. The high demand in the market caused the price of houses to rise.

Lane Duplechin, real estate appraiser, reiterates the impact that problems with supply and demand had on the real estate market. Duplechin has seen slight decreases recently in the high prices and interest rates and the market is starting to get back to normal as far as supply and demand are concerned.

“Buyers have a little more to choose from than what they had in the past three or four years,” Duplechin said.

Bridgett Menard, mortgage loan officer, explains that the new interest rates since the pandemic have made people more hesitant to buy or build a new house. Interest rates now average 7.35% on a new mortgage. This can affect the size of the house someone can build, the monthly payment on the house, and the price range of home buyers.

“The same scenario, the same house, same downpayment, same principle,” Menard said. “Today, they can’t afford it because it’s over $1,000 more.”

Menard cannot say if the interest rate will return to pre-pandemic numbers. She anticipates lower interest rates in the future but the housing market remains volatile with rates changing daily. Menard predicts more supply chain problems following lower interest rates.

The expensive sale prices, interest rates, and inflation are deterring home buyers from purchasing a new house. Menard has noticed that many clients are choosing not to buy, build, or move. The increase has made buying and building a new home difficult.

“People are priced out of the market,” Hettich said.

Inflation has caused the price of groceries, gas, and basic necessities to become even more expensive. These factors are making the cost of living even harder to manage. Consumers are spending more money. Wages have increased only 4% despite inflation. New home buyers are struggling to manage the cost of living and purchase a new home.

“The numbers are not adding up,” Hettich said.

The housing market may have reached a plateau but the prices are still at an unprecedented high. Interest rate decreases and stable supply and demand in the economy are unpredictable. The prices in the market are not guaranteed to drop in the future. Home buyers are left with the decision to move or wait for decreases to come.

Leave a comment